tax payment forgiveness program

Tax forgiveness doesnt get rid of your debt completely. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income.

New Jersey Won T Tax Student Loan Debt Forgiven By Biden Plan New Jersey Monitor

Allows you to pay no more than 5 of your discretionary income monthly on undergraduate loans.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

. For example in Pennsylvania a single person who makes. Child Tax Credit The 2021 Child Tax Credit is up to 3600 for each qualifying child. Provides a reduction in tax.

A total tax debt balance of 50000 or below. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. Form 656 s you must submit individual and business tax debt Corporation LLC Partnership on separate Forms 656 205 application fee non-refundable Initial payment.

Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the credit. Raises the amount of whats considered non-discretionary income. However if we have a valid reason for not making the.

For more information see the departments brochure on the Tax Forgiveness program. 2 days agoThe White Houses new student loan forgiveness program offers 10000 in forgiveness to nearly all borrowers and 20000 to those with Pell Grants unless you are a. IRS debt relief is for those with a debt of 50000 or less.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. States also offer tax forgiveness based on personal income standards. IRS Tax Forgiveness Program.

Agree to a direct payment installment forgiveness Earn less than 100001 200001 for joint taxpayers Owe less than 50000 at the time of application. The IRS has the final say on whether you qualify for debt forgiveness. If we have a debt with the IRS and cannot make the corresponding payment we can receive fines and penalties.

In general though the agency looks for taxpayers who. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples. These standards vary from state to state.

Instead the tax forgiveness programs assess how much you can reasonably pay given your. What Is Tax Forgiveness. COVID Penalty Relief To help taxpayers affected by the COVID pandemic were issuing automatic refunds or credits for failure to file penalties for certain 2019 and 2020.

You can also apply for the IRS. The OIC or Deal in Compromise is just one of the manner ins which the internal revenue service has created as a means to collect on the amount. Generally if you borrow money from a commercial lender and the.

Irs Debt Forgiveness Program Are You Eligible Tax Relief Center

Tax Debt Forgiveness Programs 2022 Tax Attorney Explains Your Options Youtube

New Stimulus Package Makes Student Loan Forgiveness Tax Free Student Loan Hero

Everything You Need To Know About Irs Tax Forgiveness Programs

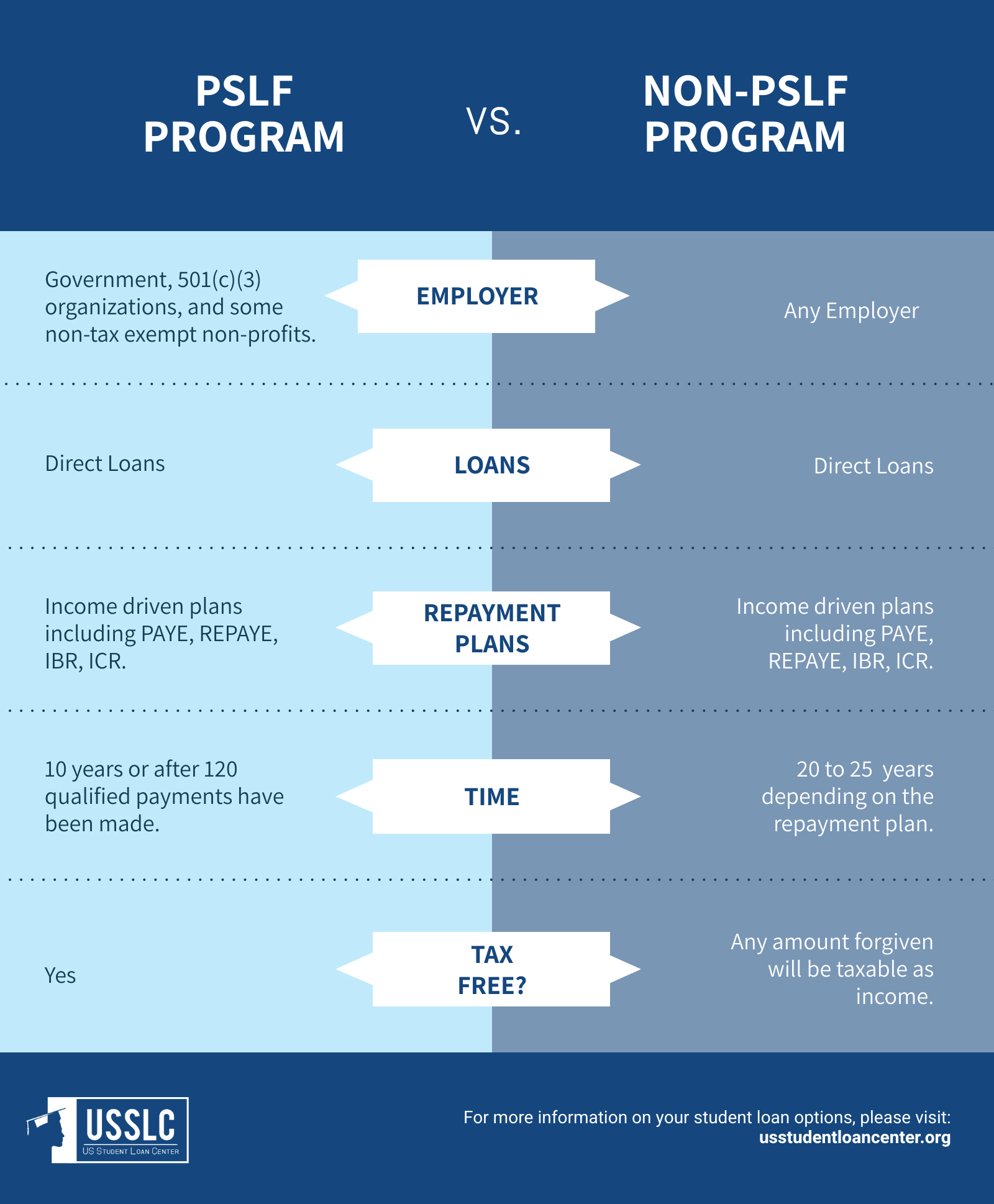

Public Service Loan Forgiveness Program

Owe The Irs 10k See If You Qualify For Irs Tax Forgiveness Program

Ppp Loans May Be Taxed At State Level Washington Business Journal

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

Tax Debt Relief Irs Programs Signs Of A Scam

Minnesota Legislators Are Considering Lifting Taxes On Federal Student Debt Relief

Some States Could Tax Biden S Student Loan Debt Relief

The Full List Of Student Loan Forgiveness Programs By State

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

The Irs Tax Debt Forgiveness Program Explained

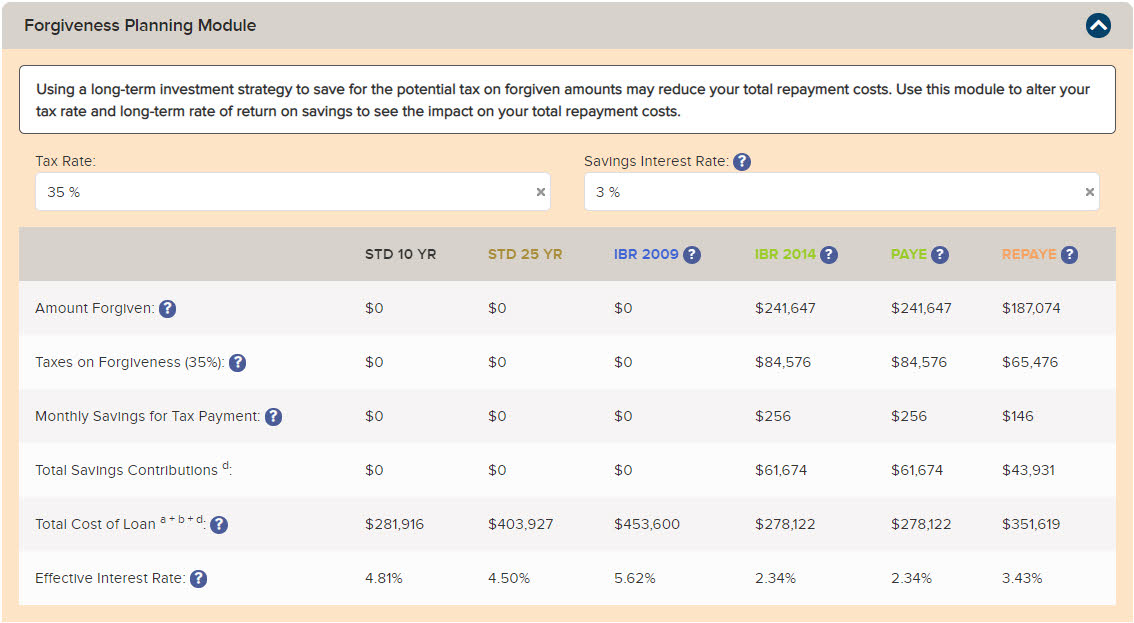

Forgiveness Planning Student Debt Center Vin

Irs Debt Forgiveness Program Are You Eligible Tax Relief Center

2020 Schedule C Self Employed How To Report Ppp Received Page 2

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet