are union dues tax deductible in nj

This legislation was enacted in 2017 after efforts led by the New York. To claim the union dues tax deductions for 2017 and prior tax years you must itemize your expenses on Form 1040 Schedule A.

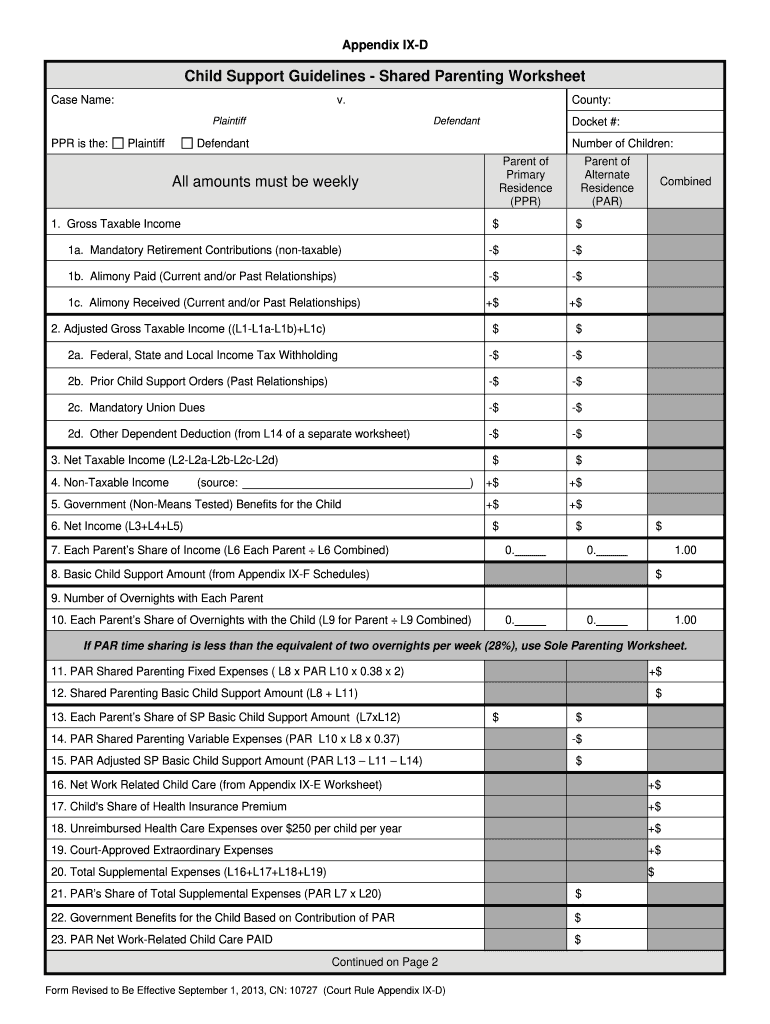

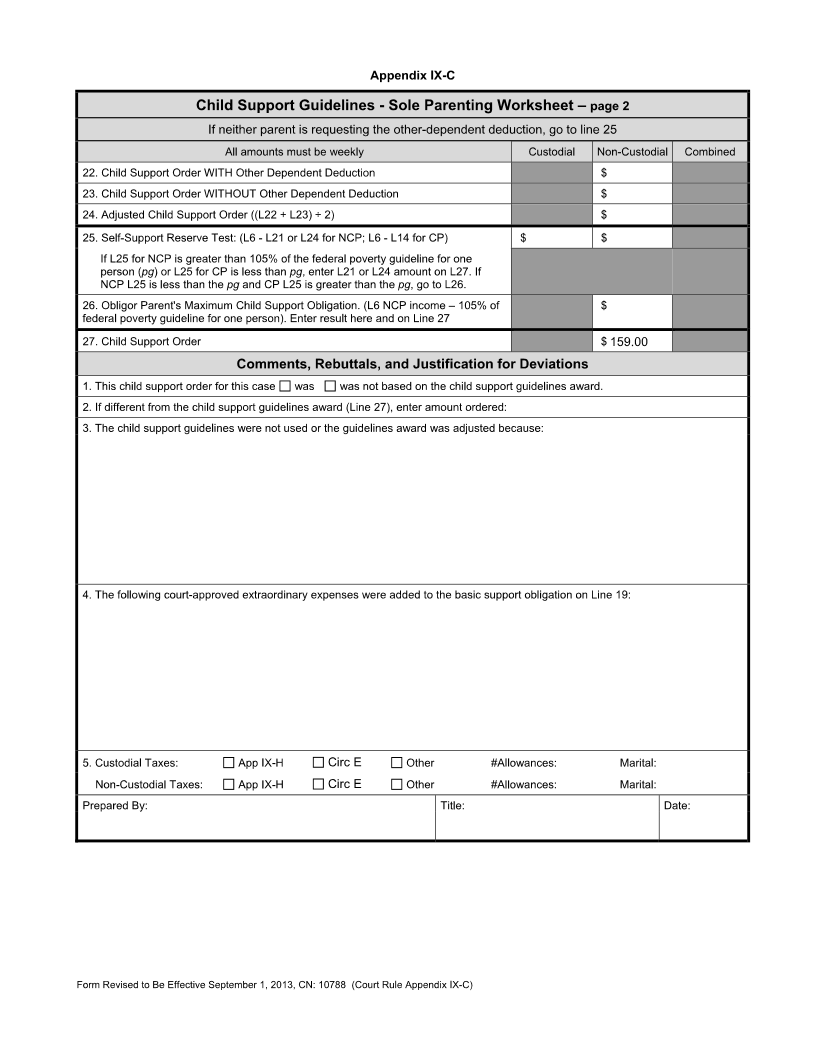

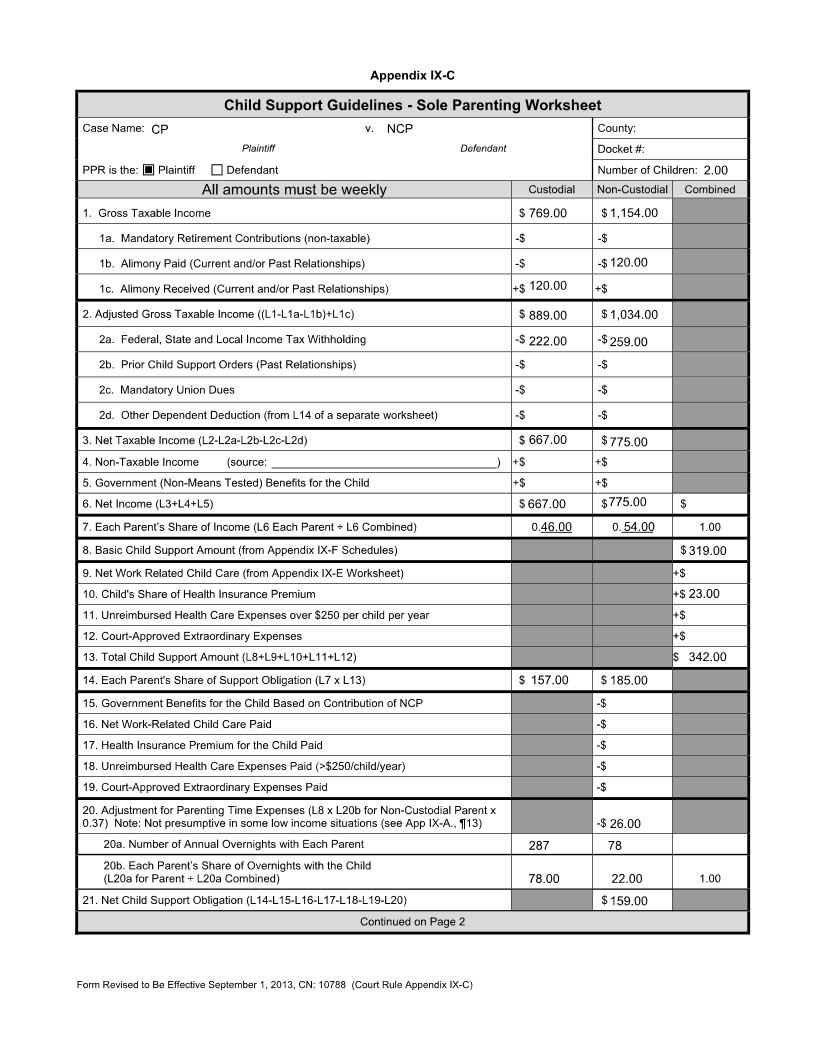

Nj Child Support Guidelines Worksheet Fill Online Printable Fillable Blank Pdffiller

NJ medical expense deduction is at 4 of AGI cap vs.

. Only unreimbursed expenses for books supplies and equipment that you purchased for classroom use qualify for the 250 Educator Expense deduction. You may claim a tax deduction on line 21200 of your tax return and if your employer is a GSTHST registrant you may be able to claim a refund for a portion of your union dues. And they lost a tax break in last years tax reform bill.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Are Union Dues Tax Deductible In Nj - Number 12 Pages 2293 2506 Law Library The New Jersey State Check cashing not available in nj ny ri vt and wy. New for Tax Year 2022 The New Jersey College Affordability Act created three new income tax deductions for taxpayers with gross income under 200000.

Governor Cuomo signed the law in our Union auditorium on May 5 2017 alongside HTC President Peter. No employees cant take a union dues deduction on their return. You can also ask them Personal Tax questions online.

With this new state tax benefit in effect it is projected to give back approximately 35 million to union members. Personal Tax experts answer this question topic Are Union Dues Tax Deductible. Tax reform changed the rules of union due deductions.

If you and your spouse. The Lifetime Learning Credit is for 20 of education expenses up to 10000 or a maximum credit of 2000. 31 2020 and has not been renewed for 2021.

Also even though unreimbursed. Thanks to new legislation union members can now deduct their union dues in full from their New York State income taxes. Its important that you do not claim your tax deduction for union dues.

If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. But if you took the itemized deduction NJ taxes health insurance premiums so they can be itemized in your NJ return as additional deductions. In Abood the Court held that a public employee could still be required to pay union dues to cover collective bargaining contract administration and grievances even if they refused to join the union.

Can i deduct union dues now. More information is available on the creditdeduction. Monday September 03 2018.

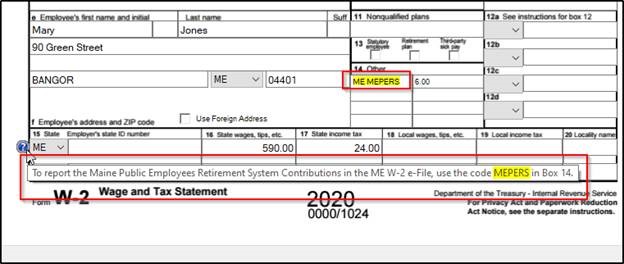

Beginning in 2019 union members will be able to deduct union dues from their New York state income taxes if they itemize deductions on their state taxes. Note that taxpayers can itemize deductions on their state taxes even if they dont itemize on their federal taxes. The amount of union dues eligible to be claimed as a tax deduction is on your T4 slip in box 44.

Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act. Lloyd Smucker R-Pa to strike the deduction was defeated 25-18 along party lines. Federally health insurance uses pretax funds union dues is subject to expenses in excess of 2 of AGI.

Educator expense tax deduction renewed for 2020 tax returns. Nov 09 2020 although the benefits available in a café 125 plan vary they are. Prior to the Act they were partially deductible as a.

Membership in the workplace organizations has at best stalled. The TCJA made union dues non-tax deductible. The TCJA made union dues non-tax deductible Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses including union dues.

Insurance is a means of protection from financial loss yet most are shady. But if you took the itemized deduction NJ taxes health insurance premiums so they can be itemized in your NJ return as additional deductions. Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions.

And they lost a tax break in last years tax reform bill. The Supreme Courts ruling made clear that a government employer cannot deduct union dues or fees from employees paychecks unless the employee has clearly and affirmatively consented to the deduction. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union dues too.

Labor Day 2018 doesnt bring much good news for unions. In order to take advantage of this new law union members must itemize their deductions on their New York State tax filings. NJ medical expense deduction is at 4 of AGI cap vs.

Fed 75 agi cap for medical expenses and you also get the health insurance premiums. An amendment sponsored by Rep. Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses including union dues.

However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. Please note that tax payers can now itemize deductions on state taxes even if they do not itemize on federal taxes. Eligible educators can deduct up to 250 of qualified expenses you paid in 2020.

Detroit Board of Education a prior United States Supreme Court case from 1977. AFSCME on June 27 2018 New Jersey should have stopped deducting dues and fees from. Politicians and the public tend to view them unfavorably.

Before 2017 union dues were a work-related expense that could be included in an itemized below-the-line deduction of expenses exceeding 2 of the employees adjusted gross income. The deduction was up to 4000 above the line but barring new legislation it is no longer available. Find your annual union dues payment amount either from the W-2 form.

The employee could only opt out of paying a portion of fees. The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one-half of the full dues for their respective membership category. A reminder for tax season.

After the ruling in Janus v. Union dues no longer deductible under new tax law. The Tuition and Fees Education Tax Deduction expired on Dec.

NJ requires you to take standard deduction if you did so federally. The deduction is above the line meaning filers can exclude the cost of dues from their. The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills.

How The Tcja Tax Law Affects Your Personal Finances

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How Much Child Support Will I Pay In New Jersey

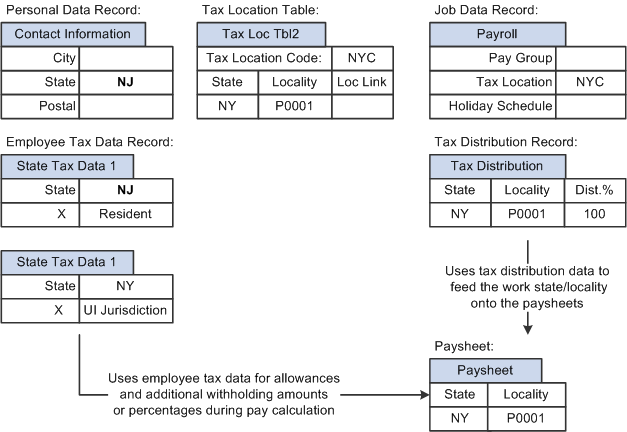

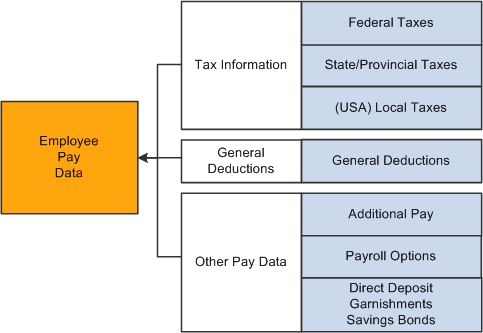

Peoplesoft Enterprise Payroll For North America 9 1 Peoplebook

Peoplesoft Enterprise Payroll For North America 9 1 Peoplebook

How Much Child Support Will I Pay In New Jersey

Number 12 Pages 1007 1120 Law Library The New Jersey State

Union Dues Are Now Tax Deductible Foa Law

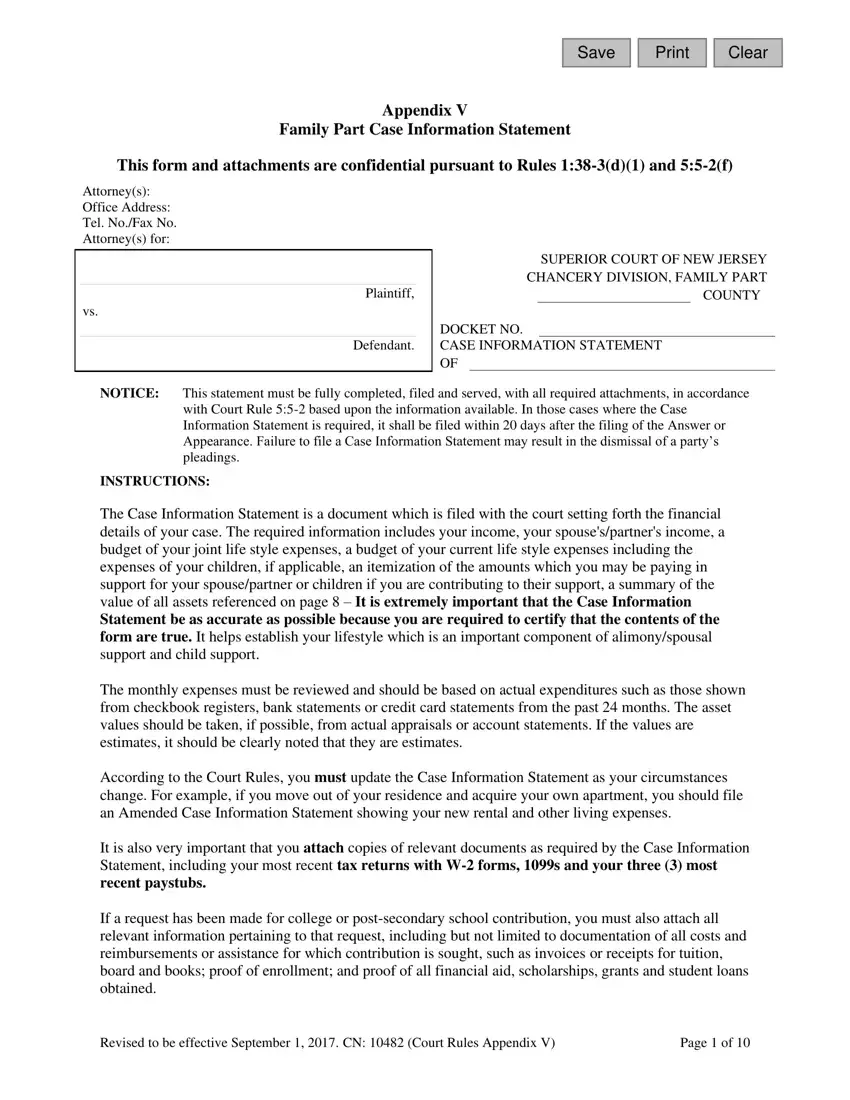

Form Nj Cn 10482 Fill Out Printable Pdf Forms Online